I never expected to feel upset about banks. Growing up, I was taught that banks were places where you put your money into a “savings account” and over time it would accumulate. The bank paid something called “interest” which added more money to the savings account. Mostly, I liked the little green bank book that was date stamped and recorded deposits. It had my name on it and it was my very own little green savings account book.

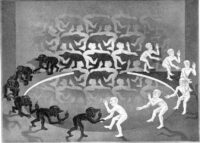

Little green bank books are long gone, and my childhood innocence about banks is gone along with them. In some unpleasant ways that seem to defy the understanding of most ordinary people, banks have undergone a radical transformation. No longer the safe and reliable institutions of my youth, today’s banks are full-fledged casino players, using depositor money to bet on the stock market and gamble on all sorts of exotic “security instruments.” Moreover, as their activities have expanded, so have their wealth; today’s mega-banks are now deemed too big to fail; meaning they can’t be allowed to go under or the whole economy sinks with them.

Keep in mind that after the stock market crash of 1929 and the creation of the FDIC in 1933, individual bank deposits have been insured by the U.S. Government. This meant that even if a bank was mismanaged, depositor savings were safe and the banks were relieved of that ultimate responsibility should they fail.

There’s talk about the rise of “socialism” these days, but U.S. Government guarantees are exactly that: the use of government money to protect individuals. Personally, it makes all the sense in the world to me. Few single individuals have the requisite financial analysis skills required to evaluate whether or not a bank is well run. The FDIC guarantee is a simple method of insuring people’s confidence that their money is safe and will not be lost if a bank is mismanaged. However, when banks use depositor funds for complicated risky investments, FDIC guarantees encourage them to be imprudent in their investing.

After banks were barred from trading in securities or other brokerage activities under regulations of the Glass-Steagall Act of 1933, they enjoyed a nice solid niche in the American economic landscape. They were boring but predictable. When the regulations of the 1930s were dropped in 1999 during the Clinton administration, FDIC guarantees became a hedge fund against reckless bank investing. When these unsafe bets failed, it was us taxpayers, of course, who had to bail out the banks to the tune of 700 billion dollars.

The big banks have America by the throat and are not about to let go now. Our federal government is weak-willed and massive campaign contributions to legislators by the banking industry have compromised legislator ethics and have made congress next to useless when it comes to protecting ordinary citizens. Not shamed by the current financial fiasco, the big banks continue to pay billions in bonuses to executives, secure in the knowledge that our government will do little or nothing to stop it. The greed that fed the recent economic collapse continues unabated, and the seeds for the next collapse are already planted. We are being robbed by the very institutions created to protect our wealth.

My little green bankbook, a childhood fairy tale, is now a great American tragedy.