For the entreprenuer, starting and solidifying a small business demands a solid plan — and funding. Even $2,500 to $10,000 can make all the difference, particularly when it’s in the form of a low interest loan. That’s where the La Luz Center Microloan program comes in, helping small businesses that might not otherwise qualify for a traditional bank loan.

Created three years ago, the Microloan program was founded with private funding. Since then, the program has provided both low-cost loans and business guidance to foster the growth and success of new and existing enterprises in the Sonoma Valley. Recipients include a seamstress, a wholesale baker, a restaurant and an auto shop owner.

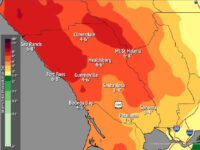

The La Luz Center Microloan program has now been expanded to aid in business recovery and expansion in Sonoma Valley after the North Bay fires.

Created three years ago, the Microloan program was founded with private funding. Since then, the program has provided both low-cost loans and business guidance to foster the growth and success of new and existing enterprises in the Sonoma Valley.

The fund offers assistance to businesses that would not be eligible for traditional bank loans.

With support from the Tipping Point Emergency Relief Fund, La Luz can now reach out to businesses impacted by the fires. The intent is to kick-start the development of new business ideas with enhanced funding, staff support and guidance.

Loan amounts are based on the merit of the proposed business plan.

Additional information on the Building Trades Training Pathway or the Microloan Recovery Project is available by contacting Juan Hernandez, executive director, juan@laluzcenter.org or Marcelo Defreitas, Board Chair, marcelo@laluzcenter.org, or by calling La Luz Center 707.938.5131.

Be First to Comment